Emerging Trends in Business Technology

Emerging trends in business technology are revolutionizing the way companies manage and optimize their financial operations. From the integration of artificial intelligence to blockchain innovations, these advancements are driving greater efficiency, transparency, and security in financial transactions. Staying abreast of these developments is essential for organizations aiming to maintain a competitive edge in the dynamic landscape of business finance.

Artificial Intelligence and Machine Learning

Emerging trends in business technology, particularly within finance, are transforming the way companies operate and compete. Artificial Intelligence (AI) and Machine Learning (ML) are at the forefront, offering innovative solutions for data analysis, risk management, and personalized customer experiences. These technologies enable financial institutions to automate complex processes, detect fraud more effectively, and improve decision-making accuracy.

Additionally, the integration of AI and ML with blockchain technology is creating more secure and transparent transactions, enhancing trust in digital finance channels. The rise of predictive analytics allows organizations to forecast market trends and optimize investment strategies proactively. Cloud computing also plays a vital role by providing scalable resources that support AI-driven applications, making advanced financial technology more accessible to businesses of all sizes.

Overall, these emerging trends are driving a digital transformation in the finance sector, leading to greater efficiency, enhanced security, and innovative financial products and services. Businesses that leverage these advancements will likely gain a competitive edge in a rapidly evolving marketplace.

Automation and Robotics

Emerging trends in business technology, automation, and robotics are transforming the finance industry by streamlining operations and enhancing decision-making processes. Advanced automation tools are reducing manual tasks such as data entry and transaction processing, allowing financial institutions to improve efficiency and accuracy. Robotics and AI-driven algorithms are now capable of analyzing vast amounts of financial data in real-time, enabling more precise risk assessment and personalized client services. Cloud computing is also playing a significant role by providing scalable and secure platforms for financial transactions and analytics. Additionally, the integration of blockchain technology ensures greater transparency and security in financial exchanges. As these technologies continue to evolve, they are fostering innovation and competitiveness within the finance sector, paving the way for smarter, faster, and more secure business solutions.

Blockchain Technology

Emerging trends in business technology, particularly in the realm of finance, are revolutionizing how companies operate and manage their resources. One of the most prominent advancements is blockchain technology, which offers a decentralized and secure way to conduct transactions. This innovation enhances transparency, reduces fraud, and accelerates settlement times, making financial processes more efficient. Additionally, blockchain enables smart contracts, which automate and enforce contractual agreements without intermediary involvement. As finance becomes more digital, blockchain’s role in supporting cryptocurrencies and digital assets continues to grow, providing new avenues for investment and payment solutions. Businesses leveraging these technologies can gain a competitive edge by improving security, reducing costs, and increasing operational agility in an increasingly digital economy.

Internet of Things (IoT)

Emerging trends in business technology are transforming the finance industry by enhancing efficiency, security, and customer experience. One of the most significant developments is the integration of the Internet of Things (IoT), which connects physical devices to digital networks, enabling real-time data collection and analysis. IoT devices like smart sensors and wearable technology allow financial institutions to monitor assets, optimize operations, and personalize services for clients. Additionally, IoT facilitates improved fraud detection and security measures by providing continuous monitoring and instant alerts. As businesses adopt IoT solutions, they can streamline workflows, reduce operational costs, and create innovative financial products. Overall, IoT is playing a pivotal role in shaping the future of finance by fostering data-driven decision-making and enhancing connectivity across financial ecosystems.

Cloud Computing Advancements

Emerging trends in business technology are rapidly transforming the finance sector, with cloud computing playing a pivotal role. Cloud advancements enable financial institutions to enhance their agility, scalability, and security while reducing operational costs. Innovations such as hybrid cloud solutions and multi-cloud strategies are allowing banks and fintech companies to optimize their infrastructure, ensuring seamless data management and faster transaction processing. Additionally, advancements in cloud-based AI and machine learning are revolutionizing financial analysis, risk assessment, and customer service. As these technologies evolve, they are fostering a more flexible, efficient, and secure financial environment, driving growth and innovation in the industry.

Digital Transformation Strategies

Digital transformation strategies have become essential for businesses seeking to stay competitive in the rapidly evolving landscape of technology and finance. By leveraging innovative tools and processes, organizations can enhance efficiency, improve customer experiences, and drive sustainable growth. In the realm of business technology and finance, adopting effective digital strategies is crucial for adapting to market changes and optimizing operational performance.

Integrating Legacy Systems

Integrating legacy systems into digital transformation strategies is a critical component of modernizing business technology and finance operations. Organizations must carefully plan how to update or replace outdated infrastructure without disrupting ongoing processes. This often involves adopting hybrid solutions that combine legacy systems with new cloud-based applications, enabling seamless data flow and enhanced agility. Leveraging APIs and microservices can facilitate interoperability, ensuring legacy systems can communicate effectively with modern platforms. Additionally, a phased approach to integration reduces risk and allows for iterative improvements, supporting a smoother transition to digital-first workflows. Ultimately, successfully integrating legacy systems is essential for leveraging existing investments while unlocking the benefits of digital transformation in finance and business technology.

Data-Driven Decision Making

Digital transformation strategies are essential for modern businesses aiming to enhance efficiency, agility, and competitiveness in a rapidly evolving technological landscape. Central to these strategies is the emphasis on data-driven decision making, which allows organizations to leverage vast amounts of information to inform their choices and optimize operations. By integrating advanced analytics, artificial intelligence, and real-time data collection, companies can identify trends, streamline processes, and personalize customer experiences. In the finance sector, these capabilities enable more accurate risk assessments, fraud detection, and predictive modeling, ultimately leading to better financial performance. Embracing data-driven decision making within digital transformation initiatives ensures that business technology investments deliver measurable value and support sustainable growth in a competitive environment.

Enhancing Customer Experience through Technology

Digital transformation strategies play a crucial role in enhancing customer experience through the adoption of advanced technology in the business finance sector. By leveraging innovative tools and systems, organizations can deliver seamless, personalized, and efficient services that meet the evolving expectations of customers.

- Implementing data analytics to understand customer behaviors and preferences more deeply.

- Adopting Artificial Intelligence and machine learning for personalized financial advice and customer service chatbots.

- Using advanced security measures like blockchain and encryption to build trust and safeguard customer information.

- Integrating digital platforms such as mobile apps and online portals for easy access to financial products and services.

- Leveraging automation to streamline processes, reduce errors, and improve response times.

Agile Methodologies in Business Processes

Digital transformation strategies and agile methodologies play a crucial role in modern business processes, especially within the domains of business technology and finance. Implementing digital transformation involves leveraging advanced technology to enhance operational efficiency, improve customer experiences, and foster innovation across financial services. Agile methodologies facilitate this transformation by promoting flexibility, collaboration, and iterative development, enabling organizations to adapt quickly to market changes and technological advancements.

In the context of finance, adopting agile practices allows teams to deliver incremental value, respond promptly to regulatory updates, and introduce new financial products or services with greater agility. Digital transformation strategies often include the integration of cloud computing, data analytics, and automation, which together streamline workflows and reduce costs. Combining these approaches empowers financial institutions to remain competitive, meet evolving customer expectations, and achieve sustainable growth in a rapidly changing technological landscape.

Financial Technologies (FinTech)

Financial Technologies, commonly known as FinTech, refers to the innovative use of technology to enhance and streamline financial services. It encompasses a wide range of applications, from digital payments and online banking to blockchain and artificial intelligence in finance. FinTech is transforming the landscape of business technology finance by making financial transactions more accessible, efficient, and secure for individuals and enterprises alike.

Digital Payments and Wallets

Financial Technologies (FinTech) have revolutionized the way individuals and businesses manage, transfer, and invest money by leveraging innovative digital solutions. These advancements enable faster, more secure, and more accessible financial services, transforming traditional banking models and expanding financial inclusion worldwide. Digital payments and wallets are core components of FinTech, allowing users to make transactions seamlessly through smartphones and online platforms without relying on physical cash or traditional banking channels. Digital wallets store sensitive financial information securely, facilitating quick payments for online shopping, bill settlements, and peer-to-peer transfers, thus enhancing user convenience and operational efficiency. As business technology in finance continues to evolve, FinTech companies are driving greater innovation, reducing costs, and delivering smarter, consumer-centric financial products that reshape the global financial landscape.

Peer-to-Peer Lending Platforms

Financial Technologies (FinTech) and Peer-to-Peer (P2P) Lending Platforms are revolutionizing the way individuals and businesses access funding and manage financial transactions. FinTech encompasses a wide range of innovations, including digital payment systems, blockchain, and online lending services that enhance efficiency, transparency, and accessibility in the financial sector.

Peer-to-Peer Lending Platforms facilitate direct borrowing and lending between individuals or small businesses through online platforms, bypassing traditional financial institutions. This technology enables borrowers to obtain funds at potentially lower interest rates and investors to earn higher returns, fostering a more inclusive financial ecosystem.

These technologies leverage advanced algorithms, big data, and secure digital infrastructure to assess creditworthiness quickly and accurately, reducing processing times and operational costs. As a result, P2P lending platforms serve as a vital component of modern business finance, providing alternative funding sources and promoting innovation within the broader financial services industry.

Cryptocurrencies and Digital Assets

Financial Technologies (FinTech), Cryptocurrencies, and Digital Assets are transforming the landscape of modern finance, offering innovative solutions that enhance efficiency, transparency, and accessibility in financial services.

- FinTech encompasses a broad range of technologies including mobile banking, peer-to-peer lending, robo-advisors, and payment processing systems that streamline financial operations.

- Cryptocurrencies, such as Bitcoin and Ethereum, provide decentralized digital currencies enabling secure, peer-to-peer transactions without the need for traditional intermediaries.

- Digital assets extend beyond cryptocurrencies to include tokenized securities, digital tokens representing real-world assets, and other blockchain-based financial instruments.

These innovations are driving the evolution of financial markets, fostering greater inclusivity, reducing transaction costs, and enabling new business models in the finance industry.

RegTech and Compliance Solutions

Financial Technologies (FinTech), RegTech, and Compliance Solutions are revolutionizing the business landscape in finance by enhancing efficiency, security, and regulatory adherence. FinTech encompasses innovative technologies that improve financial services, making transactions faster and more accessible through digital platforms, mobile apps, and blockchain. RegTech focuses on leveraging technology to help financial institutions comply with increasingly complex regulations efficiently, reducing risks and operational costs. Compliance solutions incorporate advanced software tools that monitor, report, and analyze activities to ensure adherence to legal and regulatory standards. Together, these technologies enable financial businesses to operate more transparently, securely, and competitively in a rapidly evolving digital economy.

Security and Privacy in Business Tech

In today’s rapidly evolving digital landscape, security and privacy are essential components of business technology, particularly within the finance sector. Protecting sensitive financial data from cyber threats, ensuring compliance with regulations, and maintaining customer trust are crucial for sustainable growth. As technology advances, businesses must prioritize robust security measures and privacy protocols to safeguard their operations and uphold their reputation in a competitive market.

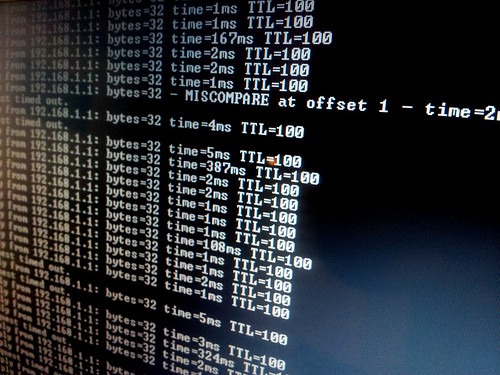

Cybersecurity Threats and Solutions

Security and privacy in business technology finance are critical components in safeguarding sensitive financial data and maintaining stakeholder trust. As financial institutions and businesses increasingly rely on digital platforms, they become prime targets for cyber threats such as hacking, phishing, and malware attacks. Implementing robust security measures, including encryption, multi-factor authentication, and regular security audits, is essential to protect financial information from unauthorized access and breaches. Additionally, adopting comprehensive privacy policies ensures that client data is handled responsibly and in compliance with regulations like GDPR and CCPA. Regular employee training and incident response planning further enhance an organization’s ability to detect, prevent, and respond effectively to cybersecurity threats, ensuring the integrity and confidentiality of financial operations in the digital age.

Data Privacy Regulations (GDPR, CCPA)

Security and privacy are critical components of business technology and finance, ensuring that sensitive financial data remains protected from unauthorized access and breaches. As organizations increasingly rely on digital platforms, safeguarding customer information, financial transactions, and internal communications is paramount to maintaining trust and regulatory compliance.

Data privacy regulations such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) play a vital role in establishing legal standards for data collection, processing, and storage. GDPR, implemented by the European Union, emphasizes user consent and the right to access or delete personal data. CCPA, applicable in California, grants residents rights over their personal information, including the right to know, delete, and opt-out of data sharing for commercial purposes.

Businesses operating in the financial sector must adopt robust security measures and comply with these regulations to avoid substantial fines and reputational damage. This includes implementing encryption, access controls, regular security audits, and transparent privacy policies. Prioritizing data privacy not only aligns with legal requirements but also fosters customer trust and competitive advantage in the digital economy.

Identity Verification and Fraud Prevention

In the realm of business technology finance, ensuring security and privacy is paramount to protect sensitive financial data and maintain customer trust. Identity verification plays a crucial role in authenticating users and preventing unauthorized access, utilizing methods such as biometric authentication, multi-factor authentication, and advanced identity verification solutions. Fraud prevention measures include real-time transaction monitoring, machine learning algorithms to detect suspicious activities, and robust encryption techniques to safeguard data from cyber threats. Incorporating these technologies helps organizations mitigate risks, comply with regulatory requirements, and foster a secure financial environment that supports sustainable growth.

Secure Cloud and Network Infrastructure

Security and privacy are critical components in business technology finance, ensuring that sensitive financial data remains protected from unauthorized access and cyber threats. Implementing robust security measures, such as encryption, multi-factor authentication, and regular audits, helps safeguard financial transactions and client information. The rise of secure cloud solutions offers scalable and cost-effective ways to store and manage financial data while maintaining strict privacy standards. Additionally, a well-designed network infrastructure incorporates firewalls, intrusion detection systems, and secure VPNs to defend against cyber attacks and data breaches. Prioritizing security and privacy not only helps in compliance with regulatory requirements but also builds trust with clients and partners, ultimately supporting sustainable business growth in the digital age.

Business Finance Management Tools

Business finance management tools are essential technologies that help organizations streamline their financial operations, improve accuracy, and make informed decision-making. In the realm of business technology finance, these tools facilitate budgeting, expense tracking, financial reporting, and forecasting, empowering companies to optimize their financial health. As businesses increasingly rely on digital solutions, leveraging advanced finance management tools has become crucial for maintaining competitiveness and ensuring sustainable growth.

Enterprise Resource Planning (ERP) Systems

Business finance management tools and Enterprise Resource Planning (ERP) systems are essential components of modern business technology, facilitating efficient financial operations and integrated business processes. These tools enable companies to streamline accounting, budgeting, and financial reporting, ensuring real-time data access and improved accuracy. ERP systems further enhance organizational efficiency by integrating core business functions such as supply chain management, human resources, and customer relationship management into a unified platform. Together, these technologies help businesses make informed financial decisions, optimize resource allocation, and maintain a competitive edge in today’s dynamic market environment.

Financial Planning and Analysis Software

Business finance management tools and financial planning and analysis software are essential components of modern business technology finance. They enable organizations to streamline financial processes, improve accuracy, and support strategic decision-making. These tools help businesses monitor cash flow, forecast financial performance, and analyze key financial metrics with efficiency and precision.

- Automate routine financial tasks such as data entry, reporting, and reconciliation to reduce manual errors and save time.

- Provide real-time financial insights that support timely decision-making and proactive management of resources.

- Enhance forecasting accuracy through advanced analytics and data modeling capabilities.

- Integrate seamlessly with other business systems like ERP, CRM, and accounting platforms for a holistic view of financial health.

- Support compliance and regulatory requirements by generating comprehensive and accurate financial reports.

- Facilitate collaborative planning by allowing finance teams to work together across departments with shared data and insights.

- Financial Planning and Analysis Software (FP&A) is vital for setting budgets, analyzing variances, and measuring financial performance against strategic goals.

- Business technology finance solutions empower organizations to adapt swiftly to market changes and optimize resource allocation.

- By leveraging these tools, businesses can improve profitability, reduce costs, and strengthen financial resilience in a competitive environment.

Automated Accounting Solutions

Business finance management tools and automated accounting solutions are essential components of modern business technology. They streamline financial processes, improve accuracy, and enable real-time data analysis, helping companies make informed decisions. These tools often include features such as expense tracking, invoicing, payroll management, and financial reporting, reducing the need for manual input and minimizing errors. Cloud-based platforms provide accessibility from anywhere, enhancing collaboration across teams and ensuring data security. Implementing automated accounting solutions allows businesses to save time, reduce operational costs, and stay compliant with regulatory standards. As technology advances, these tools continue to evolve, offering more integrations and sophisticated analytics to support strategic growth and financial stability.

Real-Time Financial Monitoring

Business finance management tools have become essential for modern companies aiming to optimize their financial operations. These tools facilitate efficient planning, budgeting, and forecasting by providing comprehensive data analysis and automation features. Real-time financial monitoring, in particular, allows businesses to track their financial health continuously, identify potential issues promptly, and make informed decisions swiftly. By integrating real-time data insights, organizations can enhance cash flow management, optimize resource allocation, and improve overall financial stability, ultimately driving growth and competitiveness in a rapidly evolving market landscape.

Future Outlook and Challenges

The future outlook for business technology and finance is filled with exciting opportunities and significant challenges. As innovations continue to accelerate, organizations must adapt to emerging trends such as artificial intelligence, blockchain, and digital transformation. However, these advancements also bring risks related to security, regulatory compliance, and rapid technological changes. Navigating this complex landscape will require businesses to be agile, proactive, and forward-thinking to stay competitive and thrive in the evolving digital economy.

Adoption Barriers and Technological Gaps

The future outlook for business technology in finance is promising, with continued advancements driven by innovations such as artificial intelligence, blockchain, and data analytics. These technologies are expected to enhance efficiency, security, and decision-making processes, enabling financial institutions to better serve clients and stay competitive. However, several challenges must be addressed to realize this potential fully.

One of the primary challenges is the adoption barriers faced by many organizations due to high implementation costs, resistance to change, and concerns over data security and privacy. Smaller firms, in particular, may struggle to allocate resources for upgrading legacy systems or training personnel. Additionally, regulatory uncertainties and compliance complexities can hinder the swift adoption of new technologies in the financial sector.

Technological gaps also pose significant hurdles. While emerging solutions like blockchain and AI hold great promise, issues such as interoperability between different platforms, lack of standardized protocols, and limited skilled workforce can impede effective deployment. Ensuring seamless integration of new technologies with existing infrastructure remains a critical concern for many businesses seeking to innovate without disrupting ongoing operations.

Overcoming these barriers will require concerted efforts, including establishing clearer regulatory frameworks, investing in workforce training, and fostering collaborations between technology providers and financial institutions. As these challenges are addressed, the future of business technology in finance looks toward a more resilient, efficient, and innovative industry landscape.

Impact of Artificial Intelligence on Jobs

The future outlook of business technology in finance is characterized by rapid innovation and ongoing challenges, largely driven by advancements in artificial intelligence. While AI has the potential to revolutionize financial services through automation, enhanced decision-making, and improved customer experiences, it also poses significant challenges that need to be addressed to ensure sustainable growth.

Artificial intelligence is transforming the job landscape within the finance sector in several ways. It automates routine tasks, improves data analysis, and enables more personalized financial services. However, this transformation can lead to job displacement for roles based on repetitive tasks, creating concerns about unemployment and the need for workforce reskilling. Financial institutions must balance technological integration with workforce development to mitigate negative impacts.

- Automation of routine banking and financial analysis tasks, reducing the need for human intervention.

- Enhanced fraud detection and risk assessment capabilities through advanced AI algorithms.

- Potential job displacement in roles focused on manual data entry and basic analytical functions.

- Growing demand for AI specialists, data scientists, and cybersecurity experts to manage and develop these technologies.

- Importance of reskilling and upskilling employees to adapt to new technological roles.

Looking ahead, the integration of AI in finance will necessitate careful regulatory oversight, ethical considerations, and continuous innovation to address emerging challenges. Businesses that embrace these changes proactively will be better positioned to leverage AI’s benefits while managing its risks effectively.

Regulatory and Ethical Considerations

Future outlook in the realm of business technology finance presents both significant opportunities and complex challenges. Advances in artificial intelligence, blockchain, and data analytics are poised to revolutionize financial services, enabling greater efficiency, personalization, and security. However, integrating these technologies requires careful navigation of regulatory frameworks and ethical considerations to ensure trust and stability in financial markets.

One of the primary challenges is keeping pace with rapid technological innovation while maintaining compliance with evolving regulations. As new financial tools emerge, regulators face the task of developing comprehensive policies that protect consumers and ensure market integrity without stifling innovation. Ethical concerns also arise around data privacy, algorithmic bias, and transparency, demanding a balanced approach that fosters innovation while safeguarding individual rights and fairness.

Additionally, businesses must address the risks of cyber threats, fraud, and systemic vulnerabilities associated with increased digital dependence. Ensuring robust cybersecurity measures and fostering a culture of ethical responsibility are essential to mitigate these risks and promote sustainable growth in the financial technology sector.

Sustainable and Green Business Technologies

The future outlook for sustainable and green business technologies in the realm of business technology finance is promising, driven by increasing regulatory pressures, corporate social responsibility initiatives, and the global push toward environmental conservation. Companies are expected to invest heavily in innovative solutions that reduce carbon footprints, enhance energy efficiency, and promote circular economies. However, several challenges remain, including high initial costs, technological integration issues, and the need for robust infrastructure to support green technologies. Additionally, there is a pressing need for clear policies and incentives to accelerate adoption, alongside ensuring that these technologies are accessible and scalable for businesses of all sizes. Navigating these hurdles will be crucial for fostering a sustainable business environment that aligns financial performance with environmental stewardship.